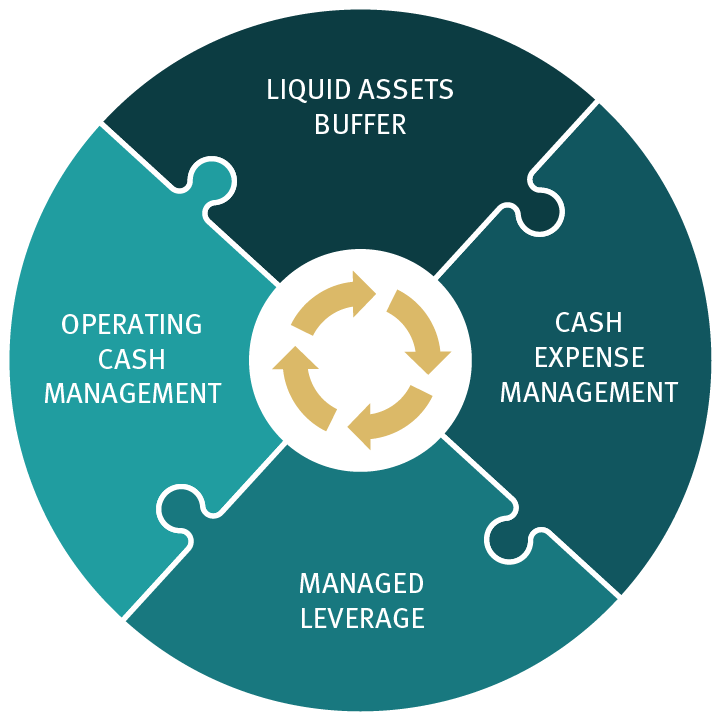

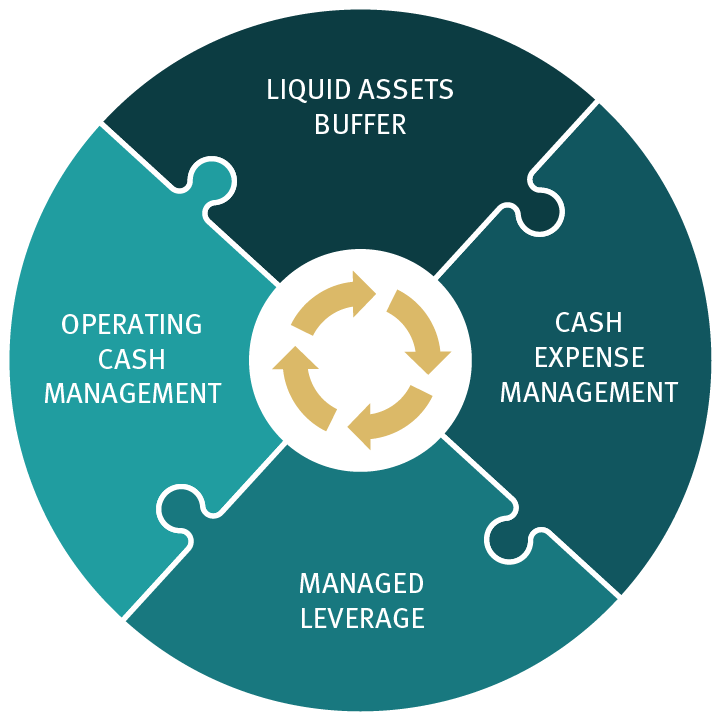

Georgia Capital intends to hold liquid assets (marketable debt securities, cash at bank and short-term and long-term deposits with financial institutions) at least $50 million at all times;

Cash expense coverage ratio (the sum of annual cash inflows from dividends and interest income from on-lent loans divided by the sum of annual cash outflows in bond interest payments and cash operating expenses) to be in excess of 1.25 at all times.

Net Debt to Asset Portfolio to be no more than 30% at all times.

Ratio of extra cash (defined as cash in excess of liquid assets of U.S.$50 million) divided by expected cash outflows over the next 180 days to be in excess of 1.0 at all times.